Annualized return calculator

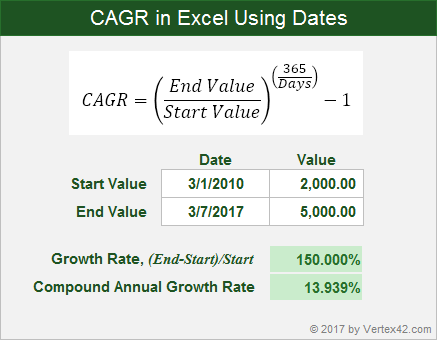

Required Rate of Return 64 Explanation of Required Rate of Return Formula. The most popular one being the annualized returns or CAGR Compounded Annual Growth Rate.

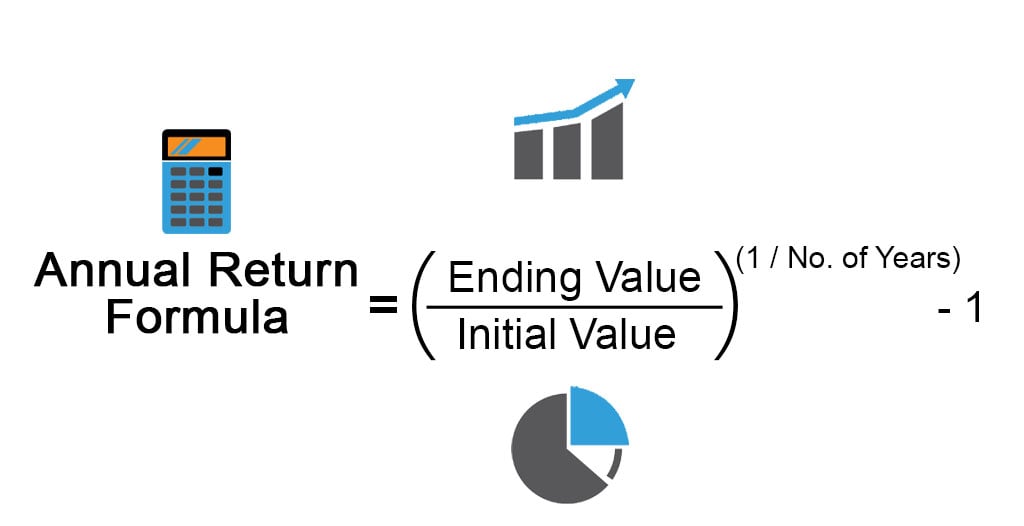

Annual Return Formula How To Calculate Annual Return Example

You can also sometimes estimate the return rate with The Rule of 72.

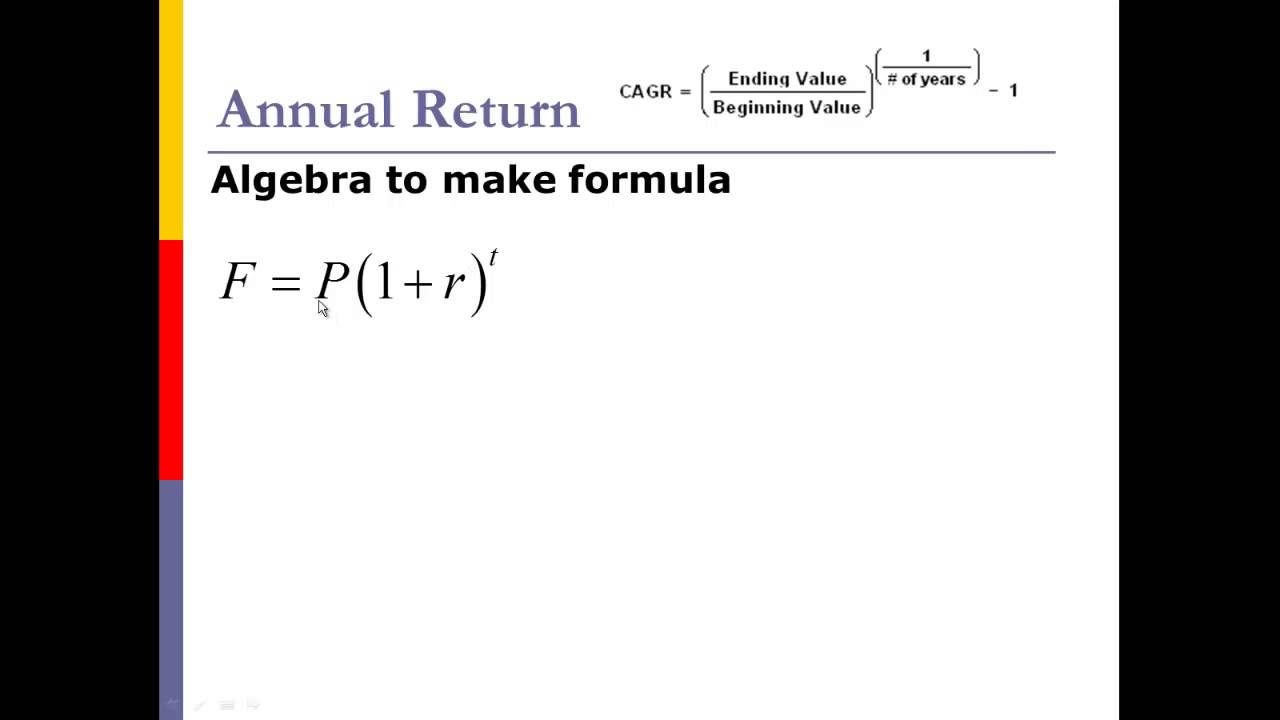

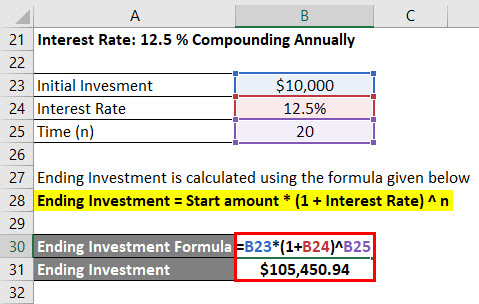

. Annualized Return Ending value of investment Beginning value of investment 1 Number years held - 1. This calculator lets you find the annualized growth. If we were to calculate the IRR using a calculator the formula would take the future value 210 million and divide by the present value -85 million and raise it to the inverse number of periods 1 5 Years and.

The results show a. No fees or taxes and inflation. On this page is a SP 500 Historical Return calculatorYou can input time-frames from 1 month up to 60 years and 11 months and see estimated annualized SP 500 returns that is average sequential annual returns if you bought and held over the full time period.

Total Return Final Amount Initial Amount. Practically any investments you take it at least carries a low risk so it is. The calculator uses monthly closing prices that are adjusted for splits and dividends.

The Annualized Return Calculator computes the annualized return of an investment held for a specified number of years. If the stock has less than three months of price data daily prices are used. Briefly youll enter the 100000 investment and then the 10000 withdrawals.

Its offerings have been generating a combined average internal rate of return of 2413 although past performance doesnt guarantee future success. Required Rate of Return 27 20000 0064. The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments.

See the CAGR of the SP 500 this investment return calculator CAGR Explained and How Finance Works for the rate of return formula. ARR also known as the accounting rate of return is the average amount usually annualized. Length of the investment determines the annualized ROI.

Access FNRP Opportunity Fund details Photo. The annualized return is the average compounded return experienced over the investment time period. The internal-rate-of-return calculator calculates a rate-of-return when theres a cash flow.

Returns on mutual funds are expressed in 2 different ways viz absolute and annualized. An annualized rate of return is the return on an investment over a period other than one year such as a month or. The total return is the change in value based on both changes in stock price as well as reinvested dividends over the entire investment horizon.

If you are looking for a similar calculator for the SP 500 with Dividends Reinvested Gold or Daily. The internal rate of return IRR metric estimates the annualized rate of return that an investment is going to yield. ROI - Practical Examples ROI Formula.

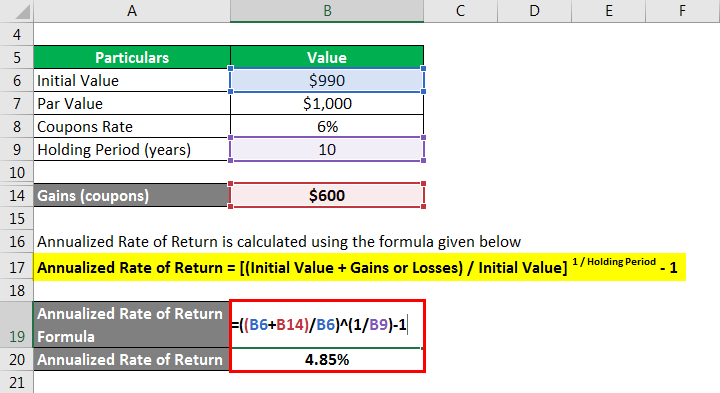

For fun there is a trophy awarded to the investment with the highest total return. Therefore the investor earned an annualized rate of return of 485 from the bond investment over the 10-year holding period. In this example administrative costs are 63 cents per square foot.

Return on investment is a ratio that evaluates how efficient a certain investment isIt is the obligatory starting and finishing point for any ambitious investor as it presents the potential of a future deal and the end results of a finished one in simple numbers. COST CALCULATOR 3 Set Joint-Use Policies 4 Apply Fee Structure STEPS 1 Enter Basic District Data 2 Enter Facilities- Related Costs. The first is based on cash flows and the second calculates a cumulative and average return of multiple investment returns with different holding periods.

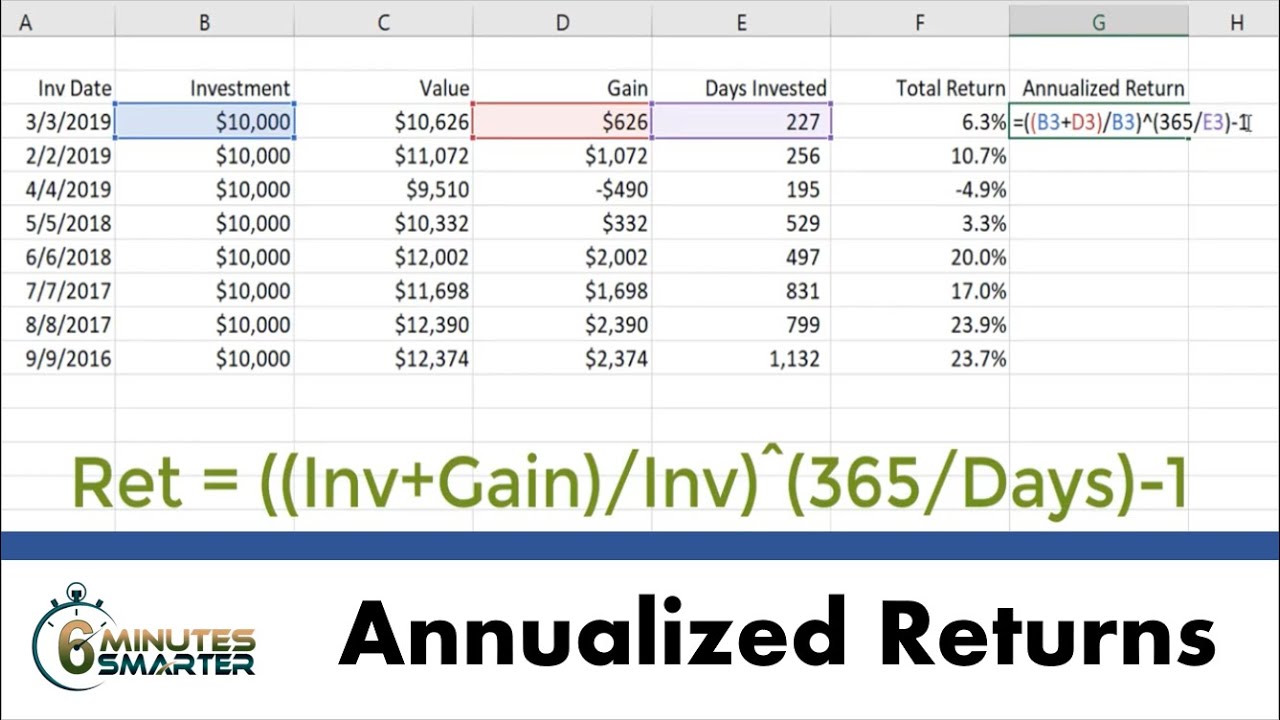

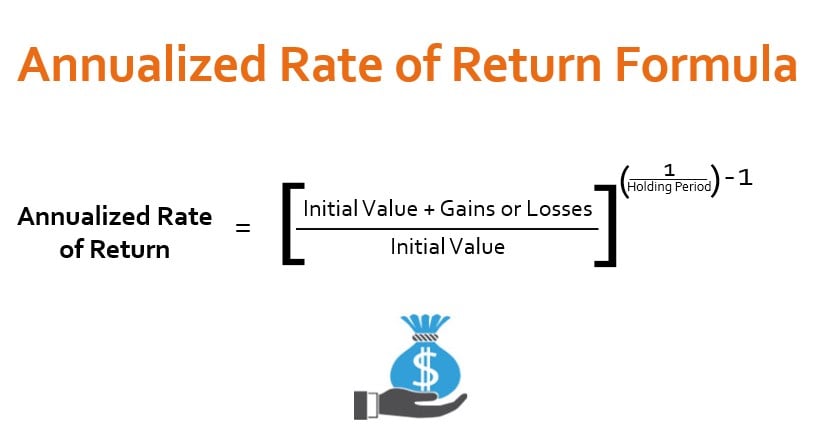

How to calculate annualized return using the Formula and Fintras Annualised Return Calculator. When comparing the results of two calculations computed with the calculator oftentimes the annualized ROI figure is more useful than the ROI figure. The formula for the Annualized Rate of Return can be calculated by using the following steps.

Annualized Rate of Return 485. Theoretically RFR is risk free return is the interest rate what an investor expects with zero Risk. The modified internal rate of return is an annualized return on investment calculation that takes into account the difference between the firm or investors finance rate and the reinvestment rate earned on the projects or investments positive cash flows.

Issues you can enter 10 in the Share Dedicated to Facilities column to calculate the real annualized cost. ROI or return on investment is a ratio between the net final value of an investment and the cost of the investment. Total Return 100Total Return Initial amount Annualised Return 1 TR1001t-1100 where TR is Total.

You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today. Volatile investments are frequently stated in terms of the simple average rather than the CAGR that you actually get. What is Annualised Return Return is the yield that an investment generates over a period of time.

The ROI Calculator includes an Investment Time input to hurdle this weakness by using something called the annualized ROI which is a rate normally more meaningful for comparison. The zero percent that you really got is the geometric mean also called the annualized return or the CAGR for Compound Annual Growth Rate. Annualized Rate of Return 990 600 990 1 10 1.

Youll need to use the IRR Calculator. On this page you can calculate annualized return of your investment of a known ROI over a given period of time. This will standardize your returns to a per year figure which shows you your true long term average portfolio performance.

The Average Return Calculator can calculate an average return for two different scenarios. In the results table the Total Return Annualized Return and Current Value of 1000 Purchase are. Return on investment ROI calculator finds ROI as the percentage change in value from the initial investment to the final value of the investment.

It is the percentage increase or decrease in the value of the investment in that period. How to calculate ROI Return on Investment Calculating annualized return. The Internal Rate of Return IRR Calculator permits cash flows to be on any date.

CAGR of the Stock Market. The Annualized Rate of Return Calculator helps you determine the compound annual growth rate CAGR of your investments. The final entry should be the total cash amount 125000 you expect to receive if you were to fully liquidate the investment.

One of the formula to calculate the annualized returns of investment is as follows. Our online tools will provide quick answers to your calculation and conversion needs. Choose to adjust for dividend reinvestment note.

Here is the step by step approach for calculating Required Return.

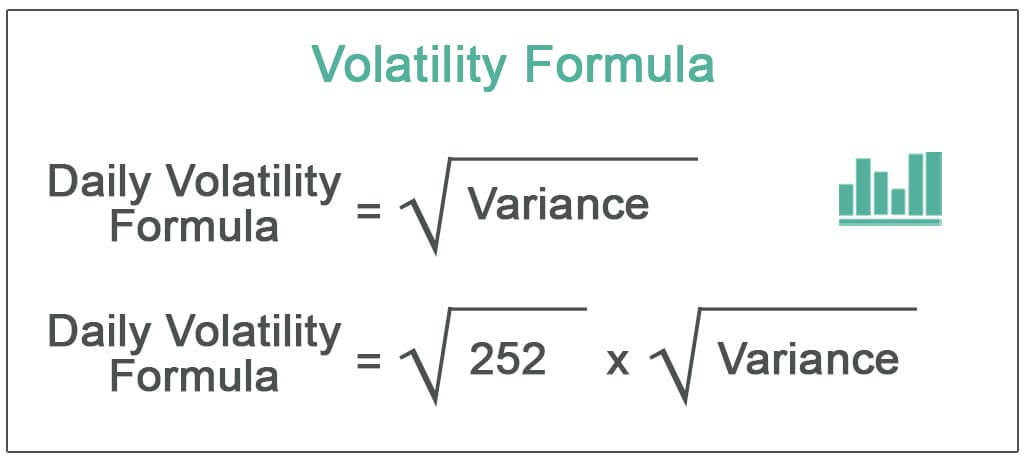

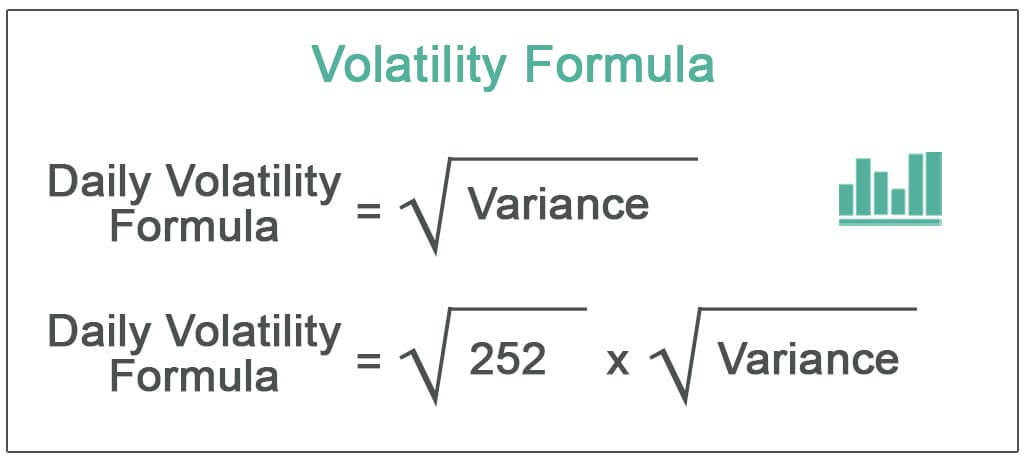

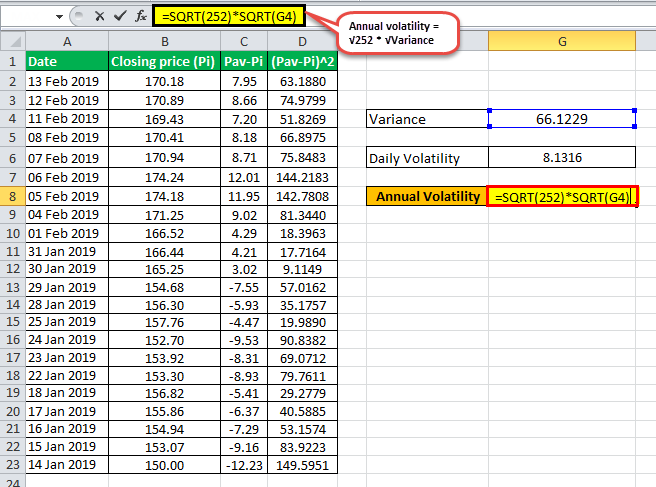

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Holding Period Return Hpr Formula And Calculator

Holding Period Return Hpr Formula And Calculator

Return On Investment Roi Definition Equation How To Calculate It

Calculate Annualized Returns For Investments In Excel Youtube

Compound Annual Growth Rate Cagr Formula And Calculation

Daily Compound Interest Formula Calculator Excel Template

Annualized Rate Of Return Formula Calculator Example Excel Template

Annualized Rate Of Return Calculator Sale 58 Off Lavarockrestaurant Com

Annualized Rate Of Return Formula Calculator Example Excel Template

Daily Compound Interest Formula Calculator Excel Template

2

Annualized Rate Of Return Calculator Online 59 Off Www Peopletray Com

Annualized Rate Of Return Calculator Online 59 Off Www Peopletray Com

Cagr Calculator Compound Annual Growth Rate Formula

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Annualized Rate Of Return Calculator Online 59 Off Www Peopletray Com